In the past three months, arbitrage funds have attracted major investments by large investors including high net worth individuals (HNIs) as well as corporate investors. The inflows into the arbitrage funds have been mainly responsible for the gush in the assets of the equity funds in the past three months. From a contribution of less than one percent a couple of years back, the arbitrage funds now contribute to around seven percent of the total equity assets under management (AUM).

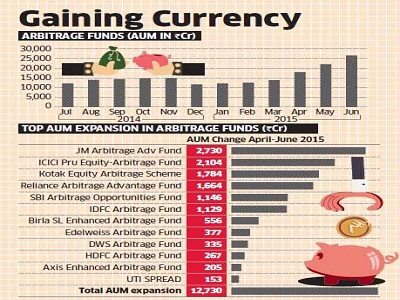

The massive investments in the arbitrage funds by such large investors has been made possible due to factors including better returns as compared to the fixed deposit returns and change in the short term tax treatment of debt funds. Eventually, in the past thee months, the AUM of arbitrage funds has increased by 92 percent accounting to Rs 26,615 crore in June from a sum of Rs 13,885 crore in March. The AUM of equity mutual funds industry, on the other hand, rose by just 8.8 percent only resulting to Rs 3.32 crore.

As per Vikaas Sachdeva, the CEO, Edelweiss Asset Management stated that the arbitrage funds have offered returns of 8.5 to 9 percent annually. In order to achieve a sustained inflow, the returns should be 30 to 40 basis points more than that of the liquid funds.

The arbitrage funds target to generate returns by tracking the price difference of the stocks that are available for trade in both the cash and futures markets. Another main reason for the increase in the investments in the arbitrage funds is the modification in the tax policies.

During the Union Budget in July 2014, the government increased the period for which the short term capital tax will be applicable on the returns of the debt funds from one year to three years. Eventually, the large investors are able to shift their investments from the debt funds to the arbitrage funds.

The experts show that the returns generated by the arbitrage funds will not grow further, and that there is a chance for the same to take a plunge in the coming months.