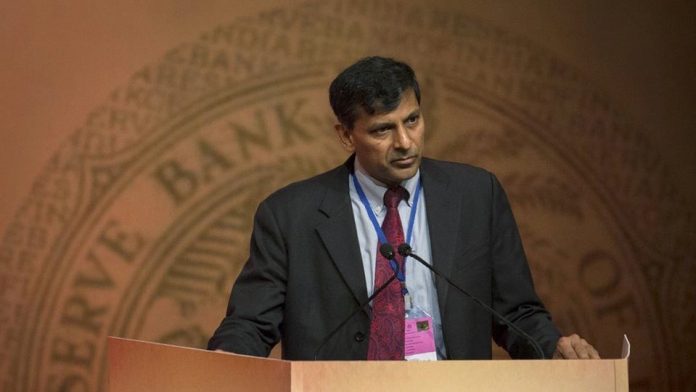

RBI Governor Raghuram Rajan pointed out that there may be a forthcoming cut in interest rates as part of new monetary policy. This cut would be possible because the quantum of inflation in India has come down to a comfort zone quicker than the expected time. He added that he is closely observing the economy and analyzing the data to see how much scope is there for them while further easing the monetary policy.

Rajan stated that RBI monetary policy has been accommodative this year and there has been already three times cut in the interest rates of monetary policies. Like other central banks of the world RBI is also in a wait-and-watch mode and a clear cut analyses is done on the incoming data to forecast how much how much monetary room is required for them for there is for more accommodation

Rajan told to Wall Street Journal that the capital flight and currency depreciation will not put RBI in a position to keep the rates unchanged. The trend of capital is that it is always attracted to strong economies of the world but in India a major part of the capital is attracted by RBI. This benefited India a lot. While other emerging markets have suffered a loss of capital or outflows in the last few months, India was safe. There has been a little outflow from the equity markets but the debt flows stayed positive.

On the discussion about what would be the drive whether growth and inflation for deciding RBI Policies, Rajan favored growth. Rajan added that the growth feeds in to an extent that it affects the inflation outlook. The global growth rate is very weak and commodities prices tend remain low for a long time and it affects the inflation outlook of India.

This made RBI’s primary focus on the inflation outlook which is supported by a good monsoon. While this helps to maintain a lower commodity prices, it is negatively affected by significantly high exchange-rate depreciation.