New Delhi, January 09, 2026 – Groww Mutual Fund has announced the launch of the Groww Small Cap Fund, an open-ended equity scheme predominantly investing in small cap stocks. The New Fund Offer (NFO) will be open from January 08 to January 22, 2026. The scheme seeks to generate long-term capital appreciation by investing in high-quality, scalable small cap companies through a disciplined bottom-up investment approach, guided by Groww Mutual Fund’s QGaRP framework – Quality and Growth at a Reasonable Price.

India’s economy is undergoing a broad-based transformation, with strengthening physical, financial, and technological capacity reshaping the opportunity set for businesses across the size spectrum. Rising infrastructure spending, deeper capital markets, improved access to formal credit, and population-scale digital platforms are reducing historical disadvantages faced by smaller companies. As a result, many small businesses today are better positioned to scale operations, access new markets, and compete more effectively.

SSHistorically, small caps have also demonstrated the potential to deliver higher long-term returns than large caps, driven by a relatively smaller base and greater headroom for growth.

Past performance may or may not be sustained in future and is not a guarantee of any future returns. The above performance does not in any manner indicate the performance of any individual scheme of the mutual fund. Please consult your financial advisor before investing.

Small caps further offer exposure to a wide and diverse set of niche, specialised, and emerging sectors that are underrepresented or absent in other segments. This breadth spans industries benefiting from structural trends as well as areas where growth is often driven by company-specific execution rather than macro cycles alone.

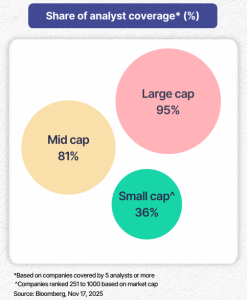

Despite this diversity, a large part of the small cap universe continues to receive meaningfully lower analyst coverage creating information gaps that can lead to opportunities for disciplined, research-led investors to identify quality businesses early in their growth journey.

Note : Large Cap Companies shall be 1st -100th company in terms of full market capitalization;

- Mid Cap Companies shall be 101st -250th company in terms of full market capitalization; and

- Small Cap Companies shall be 251st company onwards in terms of full market capitalization as per the list prepared by AMFI

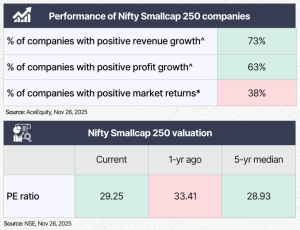

Finally, after a year of relative underperformance, the small cap segment has seen moderation in valuations across pockets, even as fundamentals for many companies have continued to improve. This combination of improving fundamentals and more reasonable valuations has broadened the opportunity set for bottom-up stock selection.

Source : NSE, data as on Dec 31, 2025

PE – Price to earnings ratio.

^Based on Q2FY25 and Q2FY26 data. | *1 year returns as on Nov 25, 2025. | Please consult your financial advisor before investing.

Past performance may or may not be sustained in future and is not a guarantee of any future returns. The above performance does not in any manner indicate the performance of any individual scheme of the mutual fund. Please consult your financial advisor before investing.

Groww Small Cap Fund follows a true-to-label mandate, investing predominantly in small cap stocks, with zero large cap exposure. The Scheme is purely bottom-up in nature, avoiding macro-led or thematic calls, and focuses on identifying businesses with strong fundamentals, sustainable growth drivers, and reasonable valuations.

At the core of the investment process is Groww Mutual Fund’s QGaRP framework, which evaluates every investment across three key dimensions of business and management quality, potential for growth, and valuation discipline.

The Groww Small Cap Fund may be considered by investors seeking long-term capital appreciation through a disciplined, true-to-label small cap strategy. It may suit those with a multi-year investment horizon who are comfortable with higher interim volatility and wish to complement existing large and mid cap allocations with selective exposure to India’s small cap universe.

Scheme details

- Scheme Type: An open-ended equity scheme predominantly investing in small cap stocks

- Benchmark: Nifty Smallcap 250 Index – TRI

- NFO Period: January 8 – January 22, 2026

- Fund Manager: Mr. Anupam Tiwari

- Minimum Investment: ₹500 and in multiples of Re. 1 thereafter

- Exit Load: 1% if redeemed within 1 year from the date of allotment; Nil thereafter

Investors are advised to read the scheme information document carefully before investing.