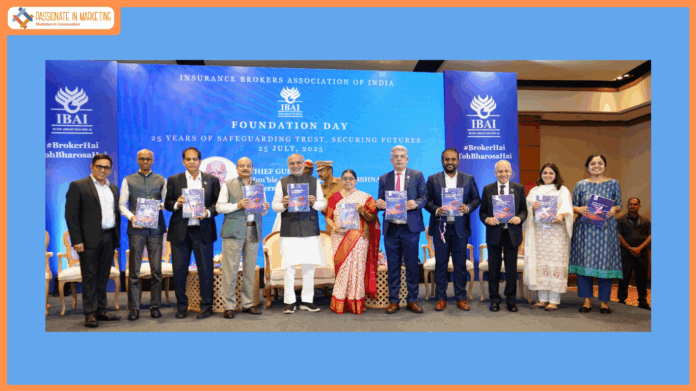

Mumbai, July 26, 2025: Insurance Brokers Association of India (IBAI) today marked its 24th Foundation Day and unveiled its report titled ‘Leading the Path to Insurance for All: Broker of the Future’, in collaboration with McKinsey & Company as its knowledge partner. The report was unveiled by Hon’ble Shri C.P. Radhakrishnan Governor of Maharashtra in Mumbai. This occasion marks a significant milestone as IBAI enters its 25th year, reaffirming its commitment to advancing the insurance broking industry in alignment with the government’s vision of ‘Insurance for All by 2047’. Looking ahead, IBAI aims to scale its initiatives through enhanced educational activities, establishment of nationwide chapters, its GIFT City chapter, and deeper engagement with international brokers. The event also witnessed the presence of Mr. M Nagaraju, IAS, Secretary, Department of Financial Services, Ministry of Finance.

Other key dignitaries and industry leaders present at the event included- Mr. Satyajit Tripathy, Member Distribution IRDAI; Ms. Girija Subramaniam, CMD, New India Assurance Co Ltd; Mr. Rakesh Jain, MD & CEO, Reliance General Insurance Company Limited; Mr. Naveen Chandra Jha, MD & CEO, SBI General Insurance; Mr. Peeyush Dalmia, Sr. Partner, McKinsey & Company (Knowledge Partner) and Mr. Abhilash Sridharan, Partner, McKinsey & Company (Knowledge Partner), along with other industry leaders.

While the report highlighted that India’s insurance sector could more than double from ₹11 lakh crore in 2024 to ₹25 lakh crore by 2030, it also points out that India’s insurance penetration could accelerate to 5% from 3.7%, bringing it closer to the global average of 6.8%.

The report features a survey of 2,500 retail customers and 100 institutional customers, highlighting key insights such as:

- The intent to buy insurance is missing, despite awareness – In the retail segment, among affluent and ultra-high-net-worth and high-net-worth customers (UHNI and HNIs are individuals with household personal financial assets over INR 8.5 crore) customers, 60% customers believe that their ideal life insurance cover should be 10 times their salary, yet only 30% have this cover. Similarly, in the institutional segment, 70 percent micro and small enterprises purchase insurance because of regulatory or client mandates.

- Insurance is a trust-led purchase – While nearly 70% of affluent and UHNI / HNI retail customers purchase insurance on the recommendations of trusted advisors, 45% of mass market customers rely on the recommendations of friends and family.

- The claims experience is a key differentiator in the insurance journey – 50% of affluent and HNI+ customers considered switching their insurers or channel of purchase and nearly half of them switched due to dissatisfaction with the claims process. Similarly, over 55% of SMEs have had their claims rejected, and over 75% seek assistance with documentation and paperwork in the claims process.

The report identifies key growth drivers for the insurance sector:

- Bridging India’s 91% protection gap (one of the highest globally), remains critical – especially for mass-market customers and SMEs, which are the most vulnerable to losses from risk events

-

- Despite being the world’s fourth largest economy, India has lower insurance penetration when compared to developed economies. Only 1 in 2 Indians (above the age of 18 years) has life insurance, and 2 in 5 Indians has health insurance. This number drops to 1 in 4, if government schemes are excluded.

- While life insurance penetration is at 2.8%, there is a significant protection gap due to limited adoption of pure term protection.

- While 65% of India’s population lives in rural areas and contributes around 45% of the country’s GDP, only about 2% of life insurance branches are present in rural regions, highlighting a significant access gap

- Retail and SME segments will be the twin engines of growth

- Gross written premiums (GWP) in the retail segment have the potential to double and reach an opportunity of up to ₹21 lakh crore, across life and non-life insurance in 2030. The mass-market segment is poised to contribute approximately 45% of the premium pool. This segment is volume-driven and although average ticket sizes remain low, its scale and growing awareness offer a meaningful opportunity despite the price sensitivity.

- Similarly, non-life GWP driven by the institutional segment has the potential to nearly triple to ₹2.8 lakh crore by 2030. Health and property lines of business will drive around 80% of institutional premiums. India has 6 crore SMEs with less than 5% having any insurance. This segment contributes only about 10% of the premium pools today but is expected to grow the fastest i.e. 4 to 5 times by 2030.

- Brokers could be catalysts for scale

-

- India has only 735 licensed insurance brokers, with the top 36 accounting for 85% of insurance broking revenue – indicating a long tail of brokers who have not scaled.

- Insurance broking in India is less matured and has potential to deepen with the entry of global players. A little over 35% of the world’s largest insurance brokers operate in India, compared to nearly 60% of the top global insurers.

- Brokers in India have limited access to growth capital which restricts their investment in technology, talent acquisition, and market expansion.

- With inflow of growth capital and regulatory enablement, brokers could evolve their proposition into trusted advisors and consolidate value in segments, such as mass market and SME, where expansion in insurance coverage is most essential.

Speaking at the event, Mr. M Nagaraju, IAS, Secretary, DFS, MoF said, “I congratulate IBAI on embarking on its silver jubilee year and commend its efforts through initiatives like the Brokers Voice survey, I Broker Magazine, and the Claims Handbook. As India moves towards the goal of ‘Insurance for All by 2047’, the role of insurance brokers becomes increasingly vital. IBAI has emerged not just as a trade body but as a responsible stakeholder and thought leader in the insurance value chain. I urge brokers across the country to actively contribute to this national mission—especially in Tier 2 and Tier 3 cities, among small businesses, and in the agriculture sector. IBAI must work closely with the government and public institutions to build awareness, simplify products, and enhance capacity, ensuring truly democratic access to insurance. I also encourage brokers to actively participate in state-level insurance programs.”

Mr. Narendra Bharindwal, President, Insurance Brokers Association of India said, “India’s insurance sector is entering a new era of opportunity, with the potential to more than double by 2030. The growth, however, needs to be secured by fast focus on bridging the massive 91% protection gap that exists in the country. At this moment, brokers have a strategic inflection point. Moving away from merely intermediaries, brokers are becoming trusted advisors that will translate awareness into action and build trust in underserved markets. Regulations permitting, with access to growth capital and investments in digital capabilities, brokers would be able to scale, drive inclusion, and form the bedrock of India’s journey toward ‘Insurance for All’ by 2047. This empowerment must begin now.”

Mr. Peeyush Dalmia, Senior Partner, McKinsey & Company said, “The Indian insurance industry is at an inflection point. Despite significant growth in premiums, the sector continues to face challenges such as a protection gap and low coverage. Transforming Indian insurance requires innovation and collaboration from all stakeholders, including insurers, brokers, industry bodies, and regulators. Brokers are situated at the intersection of demand and supply, could potentially lead the journey towards the aspiration of ‘Insurance for All by 2047’.”

The report also outlines four key interventions across the customer lifecycle to emerge as the Broker of the Future – driving demand through segment-specific and omni-channel engagement; unlocking access to traditionally underserved segments to translate economic risks into insured risks; driving product innovation as research and field execution partners and creating a transparent and seamless after-sales experience.

To read the full report, please click [here].