The Reserve Bank of India moves the deadline for card-on-file (CoF) tokenization to June 30, 2022.

The previously decided date was changed by six months from December 31, 2021, due to the various representations received from industry bodies.

Card tokenization enables a safer method for digital or online transactions involving cards. The implementation of the new system requires E-commerce sectors and merchants to delete sensitive card details like the card number, expiry date, and CVV from their servers to ensure a safer transactional process.

What is card tokenization?

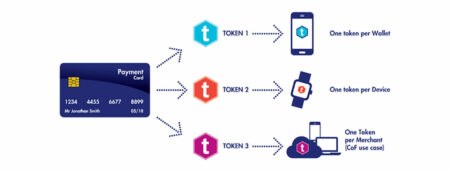

Card-on-file tokenization is a process by which the sixteen-digit card number is swapped with a non-sensitive unique code or token. This new method expects to improve customer experience by eliminating the redundancy of entering the details every single time.

In addition to that, the safer ecosystem that tokenization offers will facilitate better success rates due to improved issuer visibility and lifecycle management. Ishan Sharma, VP, Business Development at Juspay, commended the circular issued by the RBI and added that tokenization is the future of card payments.

Although the banks have equipped themselves to prepare for the transition, many of the merchants have expressed that their systems are not yet ready for the new administration. The merchants and vendors intervened to write to the RBI to extend the first deadline.

As the new model only lets the issuing banks and card networks store the details, it adversely affects the revenue of E-commerce platforms, online service providers, and small merchants, cutting it down by almost 20%-40% post tokenization norms.

According to data from a CII seminar, India has an estimated 100 crore debit and credit cards and around 1.5 crore daily transactions. The digitization of various industries and the popularity of e-commerce sectors have significantly shot up the mode of online transactions.

Subscription-based transactions and EMI paid through cards will also need to hold fast to the conditions and requirements. While consumer safety is the primary concern and focal intent of the RBI, the merchants and E-commerce providers may find the sudden alteration challenging.

Nonetheless, tokenization ensures security for the customers whose sensitive banking information will be protected.

Follow and connect with us on Facebook, LinkedIn & Twitter