Asia’s wealthiest man has pledged to hasten what he describes as a momentous leadership transition to the next generation.

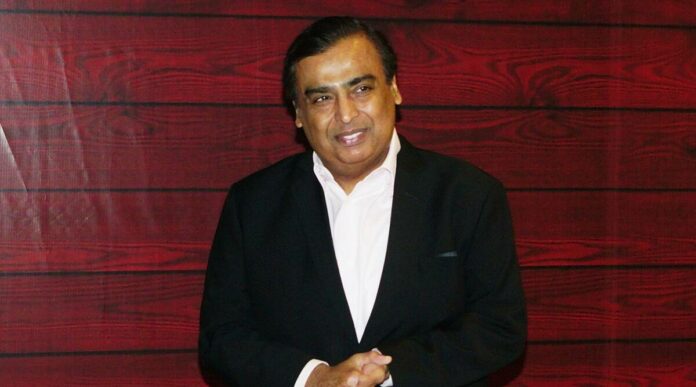

Although it is unclear how Mukesh Ambani will divide his $217 billion worth empire, one thing is certain: the much anticipated corporate succession will be anchored by the development of at least three superstar enterprises, each aiming for a big share of profit in its respective market.

The 64-year-old Indian tycoon, who was entangled in a contentious succession dispute with his younger brother after their father died without a will in 2002, values a smooth transfer of wealth.

One suggestion under consideration is to put the group’s flagship Reliance Industries Ltd. under the control of a trust-like structure to avoid any such unpleasantness. On the board would be Ambani, his wife Nita, 59, and their three children, twins Akash and Isha, 30, and their younger sibling Anant, 26.

To divide the existing oil refining and petrochemicals, telecom, and retail assets, having the family supervise everything may be a better solution. That’s because Reliance is currently undergoing a costly transition to clean fuels by investing throughout the whole value chain of solar, batteries, and hydrogen, which no other traditional energy business has tried.

The cost of capital will be the determining factor in this ambitious transformation. Over the next decade, profits from internet enterprises and retail could allow the Ambani family’s next generation of leaders to replace hydrocarbons, their traditional source of riches, with green energy.

Mobile internet, retail, and new energy are all buzzwords these days. Reliance’s balance sheet, which Ambani de-leveraged two years ago, can easily sustain another wave of leveraged expansion.

In telecom, the billionaire’s path to domination is perhaps the clearest.

The return on capital employed in the Indian telecom business fell to 3% from 8% five years ago due to an unpleasant trifecta of expensive 4G investment, severe pricing competition, and extravagant claims by the government.

According to Crisil, an affiliate of S&P Global Inc., that drag is expected to lessen immediately as operators hike tariffs, lifting the industry’s annual earnings to more than 1 trillion rupees by March 2023, a 40 percent increase in two years.

Retail may be a difficult nut to crack. Reliance is establishing a network of local stores that will accept orders using Meta Platforms Inc.’s popular WhatsApp communication program.

If Amazon will be a major competitor in retail, Ambani will face up against rival Indian tycoon Gautam Adani in the new energy sector. Adani wants to be the world’s largest renewables producer by 2030 and has pledged to invest $70 billion to achieve that goal.

Ambani has pledged a more immediate commitment of $10 billion over three years, but he has already proved his commitment to clean energy with six deals in as many months.

With any luck, the Ambani family’s next generation will inherit not one, not two, but at least three well-oiled money machines. And, hopefully, there will be no ownership problems.

Follow and connect with us on Facebook, LinkedIn & Twitter