Angel Broking has become the first in the industry to offer Unified Payment Interface (UPI) AutoPay for mutual funds. It has received an endorsement from the National Payments Corporation of India (NPCI) for the new help.

This new execution will disentangle the cycle while cutting down the e-mandate authentication time to less than a minute, Angel Broking mentioned in an assertion. UPI AutoPay will remove the e-mandate registration expense and has made its management administration conceivable with the touch-of-a-button insight.

Remarking on the advancement Vinay Agrawal, CEO, Angel Broking Ltd stated that they have included a few firsts inside the Indian stock broking space and feel glad to add another plume to the cap. The launching of this UPI AutoPay for SIPs will get rid of a few bottlenecks in e-mandate registration. He further added the company might want to stretch out genuine appreciation to NPCI for this milestone choice. Considering UPI having a huge base of clients, this new usage of UPI AutoPay will be a go-to elective for systematic investment plans (SIP) clients. It will cut down the turnaround period of e-mandate authentication for SIPs down to a couple of seconds.

The usefulness of UPI AutoPay has been dispatched by NPCI for repeating payments. Any UPI-empowered application would likewise have a mandate segment, through which clients can make, support, change, stop as well as revoke auto-debit mandate. The mandate segment will permit clients to see their previous orders for their reference and records. An example of an auto-debit mandate has been made remembering clients’ spends on repeating payments. The mandate can be set for one-time, day by day, week by week, fortnightly, monthly, bi-monthly, quarterly, half-yearly, and yearly.

Praveena Rai, COO, NPCI said that with UPI AutoPay, e-mandates can be set in a couple of seconds, which thus changes the buyer involvement experience in terms of their SIP payments and make a significant client commitment and engagement journey.

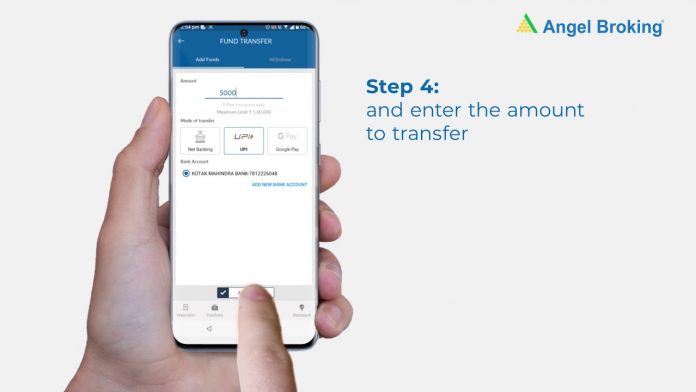

Vasanth Jeyapaul, SVP, and Business Head, CAMSPay stated that it fathoms a portion of the difficulties faced during SIP and repeating payment registration, this will give an improved financial investor experience and speedy acknowledgment of NAV. The service is presently live on the Angel BEE app and will be coordinated into its different platform without further delay.