The Financial Services industry has taken a step ahead through the implementation of Artificial Intelligence in the crucial activities of the Industry. The equitable implementation of AI has enhanced its focus on the benefits the industry can derive from its implementation.

Intelligent solutions like Advanced Analytics, Process Automation, Robotic Advisers, and self-automation are the emerging trend in the industry. The industry has to precisely focus on the perfect blend of humans and machines in the organization and analyze the internal and external outcomes of the blend. The service industry has already started implementing AI for strategic planning, enhancing revenue generation factors, and improving the overall client experience with the organization. Artificial Intelligence and machine learning are acting as stimulants which are helping the organization collect data and information about the customers that are helping the organization to particularly address the customer’s needs and expectations from the organization.

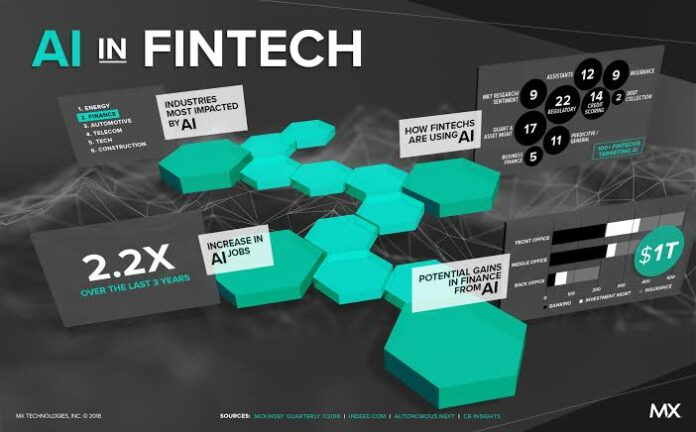

The traditional banking and financial institutions that are not efficiently adapting to the technology advancements are facing the consequences and are providing an opportunity to the fintech start-ups who are efficiently using the technological advancement as their ladder towards success. The World Retail Banking Report, 2020 addresses this customer’s relational gap that is emerging between the customers and the traditional bankers and financial institutions as these institutions are not effectively employing the benefits of data available about the customers. Fintech companies are highly sensitive about the legacy system and invest millions of dollars every year to integrate Artificial Intelligence and machine learning into their software. This not only helps in cost reduction but also keeps them updated and reap the benefits of first-mover advantage.

Financial Analytics is achieving a newer edge with the help of Artificial Intelligence. In an interview with Blake Nelson Five9’s Senior Director of Operations, he explained how Five9 has integrated the Financial Force to improve its Professional Service Automation (PSA) accounting, finance, and reporting. This has helped them to improve their efficiency of work by minimizing the time they spend on non-billable activities and focusing on billable activities. They have also replaced their previous application that had become obsolete and failed to keep up with the pace of growth of the organization. The newer application was easy-going for the employees as the FinancialForce’s salesforce made it easy to user friendly.

Fintech start-ups are rapidly growing by bridging the gap between customer’s expectations and offerings. This bridge is being aided by the software companies and FinancialForce by bringing newer innovativeness into the financial sector. These Fintech sectors aim to maximize the customers’ overall experience which lacks in the traditional Financial Sectors.