- 84% investors expect new all-time highs

February 1, 2024

Introduction:

Bitget, the world’s leading cryptocurrency exchange and Web3 company, undertook a comprehensive study to unravel the financial objectives and anticipations of cryptocurrency investors. The study aims to pinpoint pivotal trends and opportunities by conducting external surveys, offering insights to refine the Bitget platform and services.

Methodology:

The study delves into Bitcoin Halving and its potential implications for investment decisions. It encompassed a representative sample from the general population of cryptocurrency investors and anonymized the data for analysis. A diverse range of demographics was covered, including participants from countries in West Europe, East Europe, South East Asia, East Asia, MENA, and Latin America regions, totaling 9748 participants during November and December in 2023.

Bitget Study Highlights:

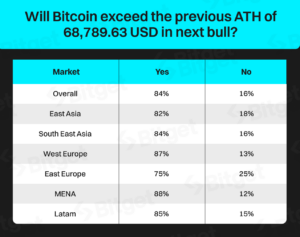

- 84% of participants anticipate BTC surpassing the previous bull market’s all-time high of $69,000, and almost all other regions exceed 80%, except East Europe.

- Globally, more than half of the respondents predict Bitcoin prices during the halving to range between $30k and $60k, while 30% of them believe the price would break $60,000.

- Approximately 70% of respondents express plans to increase crypto investments with higher proportions in MENA and East Europe indicating a stronger inclination to increase investments.

- The data suggests a “short-term cautious, long-term optimistic” sentiment among Western European investors.

Global Perspectives:

The study reveals a widespread belief in the significant impact of Bitcoin halving on its price, with approximately 78% of investors expressing this sentiment globally.

Optimism is notably high in Latin America, East Asia, and SouthEast Asia markets, with 84%, 82%, and 81% foreseeing a substantial impact. Emerging economies in MENA also express a keen interest, with proportions around 80%. West Europe and East Europe exhibit relative caution, with proportions at 71%% and 73%, respectively.

Price Expectations:

The investor predictions for Bitcoin’s price around the 4th halving in April 2024 vary across markets. Approximately 53% of investors globally anticipate the price fluctuating between $30,000 and $60,000, while 30% believe it would break $60,000.

Latin America stands out as a particularly optimistic market, with 46% of investors expecting prices to exceed $60,000 and 49% thinking it will range between $30,000 and $60,000.

Next Bull Market:

Despite the majority of the investors expecting Bitcoin prices below $60,000 during the halving, a resounding 84% of participants anticipate BTC surpassing the previous bull market’s all-time high of $69,000, and almost all other regions exceed 80%, except East Europe.

Next Bull Market Price Predictions:

The survey delves into investors’ predictions for Bitcoin prices in the next bull market. 55% of investors predict the next bull market will fluctuate between $50,000 and $100,000, while 8% of investors expect prices to exceed $150,000.

West Europe is more optimistic about the next price high, with 41% predicting it to exceed $100,000, even though investors in this region are relatively cautious about the BTC halving impact. It may indicate that these investors are ‘short-term cautious, long-term optimistic,’ as some Western European investors do not believe the Bitcoin halving will trigger a new bull market.

Among the investors who anticipate Bitcoin to exceed $150,000 in value, the greatest percentage hails from Latin America and MENA, which are also optimistic about the Bitcoin price prediction around the Bitcoin 4th halving.

Investment Intentions for 2024:

Looking ahead to 2024, approximately 70% of investors express plans to increase their crypto investments. Higher proportions in MENA and East Europe indicate a stronger inclination to increase investments.

Meanwhile, more investors in South East Asia and East Asia show a preference for maintaining their current investment positions.

Conclusion:

The Bitget Study on BTC Halving provides comprehensive insights into investors’ expectations and investment plans. With a significant majority anticipating Bitcoin’s price surge and expressing intent to increase investments, these findings offer valuable input for Bitget’s strategic enhancements. The data showcases varying perspectives across global regions, emphasizing the importance of considering these diverse expectations in shaping platform features and services.