Mumbai, December 26, 2023: GfK- an NIQ Company, has released compelling insights into the consumer durables sector for the period of January to October 2023 compared to the same period in 2022. GfK Market Intelligence, POS Offline Retail Tracking reveals a 9% surge in value for smartphones. However, the data also notes a marginal 2% decline in volume. The overall impact of this volume decrease, however, is mitigated by an impressive 11% growth in the Average Selling Price (ASP).

This nuanced combination of metrics highlights a dynamic trend within the smartphone market, showcasing the sector’s resilience and ability to maintain value growth despite a slight dip in volume.

Commenting on these findings, Anant Jain – Head of Customer Success Management, India GfK – an NIQ Company, stated, “The industry’s expansion can be credited to a noticeable consumer inclination toward premium products spanning diverse categories. Lower-town segments are significantly shaping this trend by seeking convenient tech and durable products to enhance their overall lifestyle comfort. The decrease in Average Selling Prices (ASPs) during the festive season has resulted in a comprehensive upswing in sales this year, underscoring the dynamic evolution of consumer preferences.”

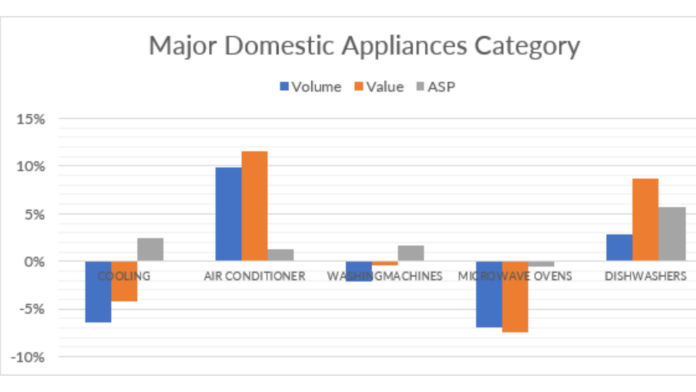

Major Domestic Appliances (MDA) and Small Domestic Appliances (SDA) exhibited varied growth rates. Cooling products, conversely, experienced a shift with a 6% reduction in volume and a 4% decrease in value leading to a category average selling price increase by 2%

At the same time, the Air conditioner category proved to be a beacon of positivity, showcasing a robust 10% growth in volume, a commendable 12% rise in value from Jan to October 2023 compared to the same period in 2022. In the realm of washing machines, a minor 2% decline in volume was accompanied by a marginal 0.5% decrease in value reflecting around 2% increase in industry ASP compared to the same period.

Microwave ovens faced headwinds, experiencing a 7% dip in volume as well as value with almost flat industry ASP. Meanwhile, dishwashers exhibited growth in both volume (3%) and value (9%), along with an increased ASP of 6% during the same period.

Within the Consumer Electronics sector, an array of trends surfaced across different product categories. The domain of audio home systems, in particular, revealed a nuanced narrative characterized by a 3% increase in volume juxtaposed with a corresponding 3% decrease in value.

This paradoxical scenario was further accentuated by a noteworthy decline in Average Selling Price (ASP) at -6%. Meanwhile, Panel Television category experienced a 2% growth in volume, but this positive trajectory was counterbalanced by a substantial 7% contraction in value due to an increased mix of smaller size PTV sale as compared to previous period.

The categories of desk computing, mobile computing, and media tablets displayed intriguing and dynamic trends. Each category underwent fluctuations in volume, value, and ASP over the specified period, highlighting the inherent dynamism within these segments of the consumer electronics market.

These findings shed light on the ever-evolving landscape of consumer preferences and market dynamics, offering valuable insights for industry stakeholders and enthusiasts alike who seek to navigate and understand the multifaceted nature of the consumer electronics sector.