New Delhi, India – February 20, 2024: Mazars in India’s PE deal tracker report unveils a comprehensive overview of the Private Equity (PE) scenario in India during Q4 2023. The quarter recorded a bustling activity with 268 deals, amounting to US$5.0 bn, showcasing the vibrancy of the PE sector. However, in terms of growth, the private equity investment activity during the quarter experienced a slowdown. While the number of transactions shrunk by 19.0% during the period, the total deal value witnessed a decline of 14.2% and reached US$5.0bn. These insights not only dissect the current trends in the PE market but also offer valuable information for those keen on understanding the intricacies of the financial landscape.

Akhil Puri, Partner, Financial Advisory, Mazars in India, “Despite the headwinds posed by global geo-political tensions and economic uncertainties, India’s deal activity in Q4 2023 showcased resilience amidst adversity. While overall transaction volumes declined, the PE deal segment displayed marginal growth, underscoring the sector’s adaptability in challenging times. The robust exit activity further highlights the market’s dynamism, positioning India as an attractive destination for investment. Looking ahead to 2024, we anticipate a positive shift, driven by India’s stable macro-economic environment, burgeoning middle class, and the global trend of diversifying supply chains. With ample dry powder waiting to be deployed and a supportive regulatory landscape, the Indian PE/VC market is poised for a rebound, with a focus on sustainable ventures and emerging sectors such as deep tech and Agri tech.”

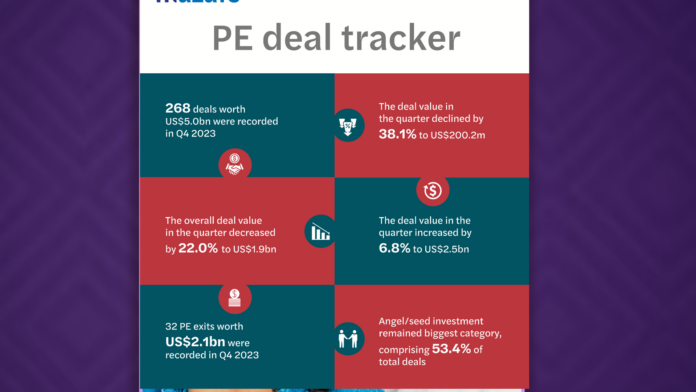

PE deal activity in India – Q4 2023 highlights:

In the final quarter of 2023, Private Equity (PE) investments in India peaked with 268 transactions, totalling approximately US$5bn, marking it as the most active quarter in terms of deal volume for the year. However, despite the high activity, there was a slowdown in growth, with transaction volume dipping by 19.0%, and total deal value falling by 14.2% compared to Q4 2022, reaching US$5.0bn from US$5.8bn.

PE activity by stage of investment:

Angel/Seed investment trend:

In Q4 2023, Angel/Seed investment continued to dominate the PE deal landscape, representing 53.4% (down from 56.8% in Q4 2022) of total deals. However, this category saw a significant downturn in both volume and value, with transactions dropping by 23.9% to 143 deals and the deal value plummeting by 38.1% to US$200.2m.

Venture capital investment trend:

The venture capital category emerged as the second most active, constituting 37.6% of the total deal value and 32.1% of the overall transaction count. However, compared to Q4 2022, this category experienced a notable decline of 22.0% in value during Q4 2023, dropping from US$2.4bn to US$1.9bn. Additionally, the total deal volume for the quarter decreased by 16.5% to 86 transactions.

Private equity investment trend:

In Q4 2023, private equity investments stood out as the only category showing growth in both deal volume and value. With 27 transactions recorded, the category experienced an 8.0% increase in volume and a 6.8% growth in value from Q4 2022. The category’s share in the total PE deal value expanded by around 10.0% to 50.4% in Q4 2023, compared to 40.5% in Q4 2022.

PE exits in India – Q4 2023 highlights:

In contrast to PE investments, exit activity surged significantly in Q4 2023, marking the second most active quarter in the last six quarters in terms of exit numbers. Q4 2023 witnessed a rapid growth in PE exits, with 32 deals totalling US$2.1bn, representing a substantial 68.4% increase in volume and a 41.9% increase in value over Q4 2022. Prominent exits include Blackstone’s exit from Embassy Office Parks REIT valued at approximately US$850m and ChrysCapital’s exit from Mankind Pharma valued at around US$393m.

PE exit trends by exit route – Q4 2023 insights:

In Q4 2023, the open market and secondary sales routes experienced a remarkable surge in exit value growth, with open market exits increasing by an impressive 98.1% and secondary sales by 33.9% compared to Q4 2022. However, the merger/acquisition exit route saw a staggering 93.5% contraction. In terms of exit numbers, all routes saw increased activity, with the merger/acquisition route leading the way with a remarkable 150.0% surge, followed by secondary sales with a 125.0% increase, and the open market route witnessing an 18.2% growth.

For more detailed insights and analysis, you can access the complete PE Deal Tracker by Mazars in India.