For decades the wealth wing Mukesh Ambani inherited from his father helped him to create a kingdom of his own.

After a low in March, the stock has more than doubled to a high as Reliance’s digital infrastructure business unit, Jio Platforms Ltd., raised nearly $16 billion in a fundraising spree. Much of this at a time when sentiment remains volatile on the oil market, even though prices have stabilized from a two-decade down. Yet as Ambani addresses shareholders at Wednesday’s annual meeting of Reliance Industries Ltd., he will speak for an empire that is gradually breaking away from oil-price fortunes.

Ambani ‘s vision to turn Reliance into an energy firm into an e-commerce powerhouse has been driven by the whirlwind of deals for Jio. They’ve even reduced the impact of oil on the stock price of the firm. The company’s shares currently have a beta of 0.14 for Brent crude, which means that a 1 percent weekly decline in oil allows Reliance to fall by no more than 0.14 percent.

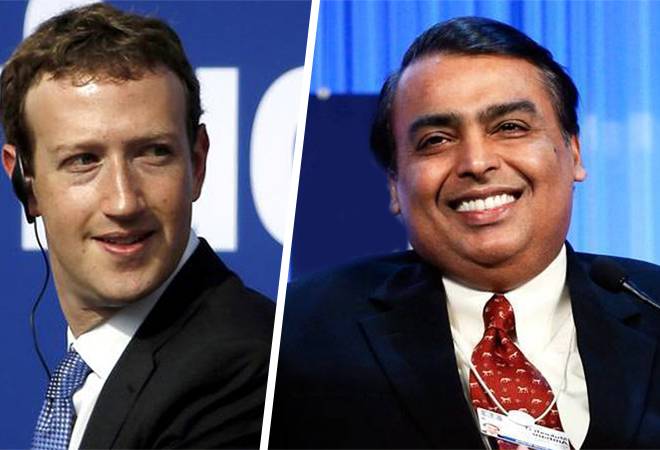

Jio is at the forefront of Ambani’s push to create Alibaba Group Holding Ltd.’s homegrown version. The tie-up with Facebook brought Silicon Valley acceptance stamp to the company and has drawn a dozen buyers, excited about the unit ‘s ability to shake up internet shopping, video sharing, digital payments, education, and health care in a 1,3 billion-person market.

Reliance has picked up a lucrative Facebook investment of $5.7 billion (Rs 43,574 crore) in exchange for a 9.99 percent stake in Jio Platforms, the company that will hold much of the empire’s digital properties. Facebook believes the tie-up to make WhatsApp the predominant way in which millions of small businesses in India communicate with customers. The messaging app has around 400 million users in the world, approximately the same as the customer base for wireless services of Reliance Jio Info COMM Ltd.

Ambani seems to have more than just a few reasons to be happy too. The investment and corresponding valuation of Facebook are higher than the average Rs 4.2 trillion enterprise value given by top brokers such as Citi Investment Research, Kotak Institutional Equities, JP Morgan India and Goldman Sachs India to the firm.

As stated, the selling of Jio’s 25.2 percent stake along with the $7 billion rights offer to Reliance shareholders encouraged Ambani to declare its flagship free of net debt sooner than its goal of March 2021. BP Plc invested $ 1 billion last week for a 49 percent stake in the fuel-retail sector of the group, closing a transaction announced in 2019. Reliance said as of March it had net debt amounting to 1.6 trillion rupees.

Monday’s stock closed nearly 13 percent higher than its average price target of one year. The momentum that accompanies Reliance ‘s digital and telecom forays is expected to help the premium for now.