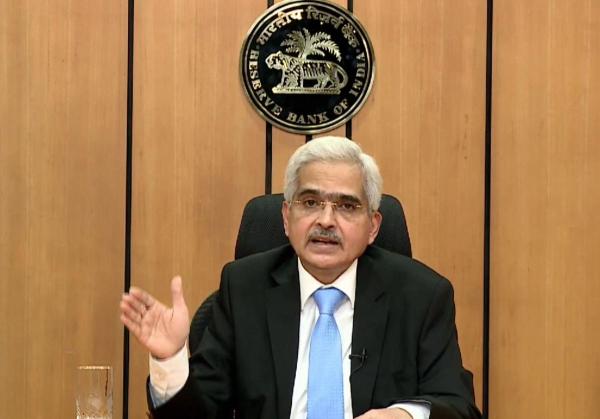

On Saturday, RBI Governor Shaktikanta Das said banks need to raise capital anticipatory basis to increase the capital buffer to reduce the risk associated with covid19. Bring in the capital and creating buffers is important not only for credit flow system but also to rebuild the financial system.

It is important that the bank should improve its governance and increase its risk management skills and banks have to bring in the capital ahead not waiting for the situation to arise.

Public and Private sector bank should proactively build up sufficient capital buffer. The capital buffer rate differs from banks to banks, and the reserve may exceed the limit set by the central bank.

The pandemic lockdown and anticipated post lockdown has impacted economic growth. The reduction of economic growth may result in higher non-performing assets and the disintegration of banks. A plan for recapitalization is necessary for public and private sector banks.

The government had infused for public sector banks the amount of Rs 3.08 lakh crore. For five years i.e. 2015 -16 and 2019-20. In budget 2020-21 the government stopped committing any capital for public sector banks. So that the lenders will raise funds to form the market accordingly.

This fiscal year banks in the public and private sectors like Canara, State bank of India, PNB, ICICI, and HDFC bank are trying to raise their capital through various means.

The non-banking financial companies ( NBFC’s) and banks are asked to conduct a stress test by the governor to analyze the effects of covid19, in their balance sheet, and prepare for any possible risk. And RBI advised us to assess the effects of a pandemic on asset quality, liquidity, profitability, and capital sufficiency for the fiscal year 2020- 21.

On the basis of the outcome, the banks and the NBFC’s are required to take measures to reduce the impact and include capital planning, liquidity planning, and capital raising.

Adhering the minimum capital requirements is necessary but it solely won’t make the financial stability. Approach to this risk management in banks should be more frequent and different from bigger risk in the past.

The main is to maintain the financial stability of banks and sustainable upgrade their capabilities with respect to their governance and risk culture.