Post demonetization our currency Indian rupees has started circulating in the economy or market. Digital payments have also gone up.

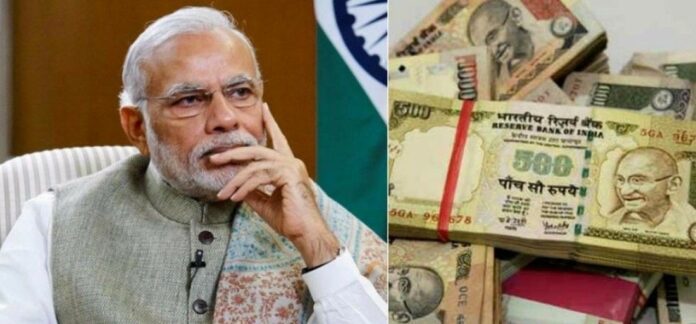

On Tuesday is 8 November 2016 Government of India declared demonetization. Where Government of India decided to withdraw the currency of 500 and 1000 rupees notes. This demonetization was introduced on date November and ended on Friday that is 30th December 2016.

Under the BJP government and mode leadership of Mr. Narendra Modi India decided to demonetize currency in an attempt of getting the black money corrupted money out of the pockets of a few corrupted Indians.

Many people were with and many people were was against this decision of demonetizing currency. Quite a few economists have said that this will take the economy down for some time but this is a good move.

Following the demonetization, government introduce new currency notes of rupees 500 and 2000 full stop the new series of 500 rupees notes were introduced initially 200 rupees note was also added. Going ahead in this change notes of rupees 100, 50, 10, 20 were changed and brought in with the different number series.

After 5 years of demonetization, we will be reviewing the facts and figures of demonetization and eventually the effects as well.

Indefinitely brought in the hidden money back to the government full stop people had to suffer for cash and had to stay in the queues for longer periods, But at the same time introduced India digital payments, services like UPI which have been a great find.

The circulation of money continues to rise albeit at a slower pace but also the digital payments increased more and more while people were going cashless to make the payment.

Initially, the banknotes in circulation went up in the financial year 2020-21 because people opted to go cashless fearing the covid-19 handling cash during the period of covid-19. Covid-19 disrupted the various economic activities.

In a recent study, it was noticed that the digital payments in India have gone past the digital payments in the USA and China together. This means that the payments have been made digitally made by plastic cards, net banking, UPI, etc.

According to the latest data of the Reserve Bank of India notes in circulation were valued at lakh crore on October 29, 2021, which was 17.7 4 lakh crore on November 4, 2016, Which is great in itself.

Follow and connect with us on Facebook, LinkedIn & Twitter