Exploring the ins and outs of consumer behavior, psychological motivators, decision drivers and more, Smytten’s report provides actionable insights for brands to help them tailor their marketing strategies to meet the ever evolving needs of modern consumers

Smytten, India’s largest tech-enabled D2C product discovery and trial platform conducted a large-scale consumer survey to provide key insights into consumer behavior and decision-making. The survey collected data from 15,000 Indian customers across various demographics, via Smytten Pulse, the country’s first AI and machine learning-backed platform for D2C brands.

Through their comprehensive analysis, Smytten has delved into the key factors that influence how customers evaluate brands and the drivers and barriers for their purchase. The study further dissects consumer behavior across 5 focus categories – personal care, makeup, fragrances, health & wellness and food & beverages – to provide key insights on basket expansion and category-focused implications to build and optimize business strategies.

The Indian D2C industry is at its peak, with the market size of more than 800 D2C brands and a projection to be a 100 billion US dollar industry. In this dynamic space, a brand has to solve for the modern Indian consumers’ ever evolving needs and build a strategy that will make them become a disruptor.

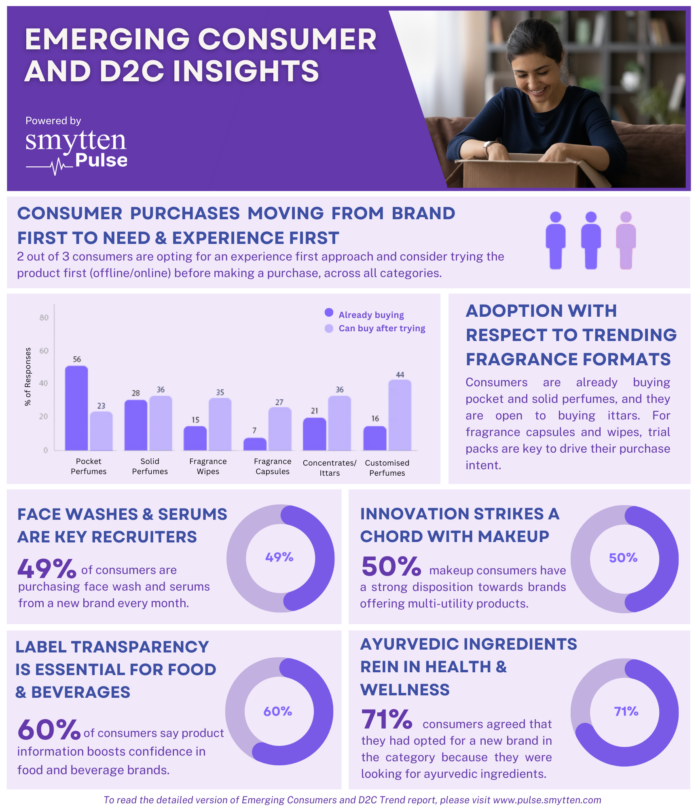

According to Smytten’s survey, consumers’ purchase behavior is influenced by various factors such as price, effectiveness, transparency and authenticity. Additionally, the survey found that consumers are increasingly interested in products that align with their belief for “function over emotion,” especially when it comes to the ingredients being used.

Smytten’s survey also shed light on the importance of customer experience, when it comes to consumers shopping directly from the brand’s websites. Brands that can provide attractive deals, free or low delivery fee, product information and a hassle-free shopping experience are likely to gain a competitive edge.

Speaking on the survey and the launch of Smytten Pulse, Swagata Sarangi, Co-Founder, Smytten said, “We wanted to build a platform for the next generation of founders who are truly going to disrupt the consumer brand space. With Smytten Pulse, you can now get consumer data at your fingertips within 72 hours. Gain information on emerging trends from over 15 million users driven by AI, track how the consumer basket is moving on a real time basis and find insights cut across demographics and psychographics.This research was the first large scale survey conducted, and we’re elated to share the insights with everyone in the D2C space.”

The key findings are across all five categories:

- In the Personal Care category, 93% of consumers actively seek verbalisers like dermatologist verifications, detailed information on how the product formulation works, suitability for all skin types and brand authenticity.

- 33.3% consumers take supplements daily with half of them willing to pay more for ready to consume protein. This makes Health & Wellness a category with a lot of potential for growth.

- At least 1 in 3 consumers who shop online are buying new brands every month in the Food & Beverages category. DIY meal kits with recipes and pre-portioned ingredients are growing in demand.

- In the fragrance category, India has seen 100% growth in purchase frequency in the last year with 96% of the consumers buying Fragrances from an online marketplace instead of a brand website.

- Lipsticks emerge as the most dynamic subcategory in the Makeup category with at least 50% of makeup consumers purchasing a new lipstick once every 2 months at an average price of INR 491.

It is interesting to note that 63% of the consumers are willing to try products before purchasing, given the newer innovations available across categories like fragrance capsules/wipes, DIY salon kits, beauty edibles, ayurvedic juices, plant based meals, etc.

This report is a must-read for all brands that aim to become future winners in the D2C space. To read the detailed version of the Emerging Consumer & D2C Trends report, visit www.pulse.smytten.com.

*The Smytten Pulse Survey was conducted with 15,000 men and women between the ages of 18-45 years across Tier 1 and Tier 2 cities & towns.