A financial assessment is a mathematical incentive between 300–850 that decides a person’s reliability

Beginning right at the top, before applying for an advance, you need to comprehend there are a couple of essentials that should be given consideration.

Allow us to accept you need an advance to satisfy something that you’ve been making arrangements for a long. Unforeseen costs toss a spanner in progress for your monetary investment funds plan. All things considered, that is the place where monetary help becomes possibly the most important factor.

Beginning right at the top, before applying for credit, you need to comprehend there are a couple of essentials that should be given consideration. As a matter of first importance, your FICO assessment.

What is a FICO rating

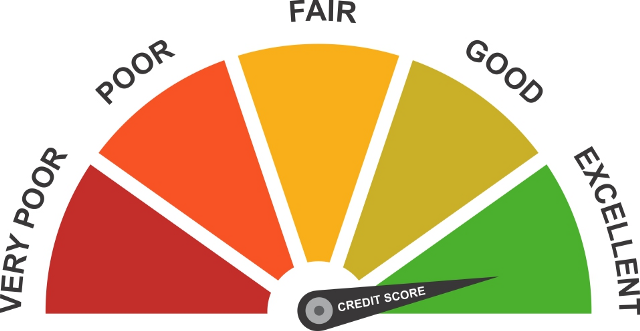

A FICO assessment is a mathematical incentive between 300–850 that decides a person’s financial soundness. Factors like several open records, obligations, Visa bills, advance and reimbursement history, and so forth, impact your FICO assessment. Higher the FICO rating, better possibilities for you to protect a credit with a lower loan cost and appreciate numerous advantages.

Why check the FICO rating?

Keeping a standard track of your FICO assessment and financial record can end up being advantageous. Thusly, you can recognize your deficiencies and unexpectedly improve your FICO rating. It will likewise help you keep steady over any mis-reportings and amend such mistakes as quickly as time permits.

Advantages of a decent FICO assessment

On the off chance that you have a decent FICO assessment and guarantee you stay inside that range, you are ensured to appreciate a few advantages. You will quite often meet all requirements generally advantageous (low) financing costs and you can get affirmed for advances and Visas with no problem.

Why are credit reports utilized?

A credit report is a definite summation of how proficient you have been in covering bills and keeping steady over your reimbursement of advances (assuming any). For a loan specialist, the credit report will decide if you are a reasonable competitor or not for credit. It will likewise set out the terms on which the credit line has been affirmed. It is critical to check your credit reports consistently to guarantee the data is precise and complete.

FICO ratings are mathematical qualities, for example, Reasonable Isaac Company score or credit rating. These scores are 3 digit numeric portrayals of a person’s financial soundness and reach from 300 to 900.

A Perpetual Record Number (Skillet) card is required while checking your FICO assessment since it is a person’s very own distinguishing proof report.

FICO rating requests can adversely affect your score. A telephone number is expected to convey your FICO assessment and credit report to you. Factors, for example, advance history, Mastercard obligation, consistency in reimbursement, open records, and mis-reportings can influence your FICO rating and change it.