Focused equity funds are known for their portfolios that contain high conviction picks. These scheme plans can move across shares of organizations of all sizes. Numerous investors wish to bite the bait of investing resources into the best ideas of a fund supervisor or manager and advantage from top-of-the-chart returns, however, there is no assurance that it would work.

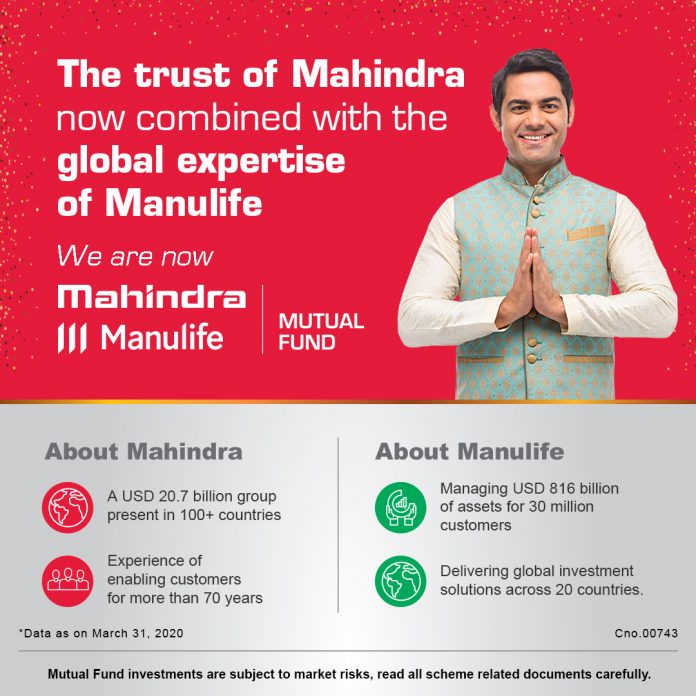

Mahindra Manulife Mutual Fund has revealed another new fund offer, called the Mahindra Manulife Focused Equity Yojana (MFEY), the scheme plan opened for subscription from October 26, 2020. MFEY is a focused fund intending to offer a concentrated portfolio arrangement of 30 stocks as defined by the scheme plan classification of the Securities and Exchange Board of India (SEBI). Krishna Sanghavi will be the fund manager. The NSE 500 TRI is the benchmark for the scheme plan. The fund house is one of the most up to date kids on the block, having begun activities and launched its first scheme plan only four years back.

The plan aims to construct a portfolio arrangement of handpicked stocks after applying filters, for example, development prospects of the business, quality strength of cash flow, nature of the management, and valuations. Since there are a predetermined number of stocks (30) compared with a regular typical diversified reserve, which holds around at least 50 stocks, there is more designation on an average to every individual stock in a focused asset. In case the fund manager gets the call right, at that point, there is a reasonable possibility of improving returns than most other diversified funds. Since there are no limitations on the fund manager in allocating to shares of organizations of explicit sizes or market capitalizations, there is more opportunity to pick stocks. MFEY isn’t the principal focused equity scheme plan in the market. There are 23 focused equity scheme plans with resources worth Rs 52,797 crore as of September 30, 2020, as per Value Research. In the last year, focused funds have given 2.44 percent returns on a normal as a category. Since the NFO being referred to offers a strategy that is now accessible to the financial investors through existing focused assets, it makes sense to skip it until further notice. The plan can be considered for investment after it builds a healthy track record. The NFO closes on November 9, 2020.